Our investment strategy is to acquire apartment communities in growth markets across the U.S. and create value through intensive asset management. We are actively pursuing acquisitions ranging from $5MM to larger portfolios with no practical limit. Our team can react quickly and efficiently to complicated transactions.

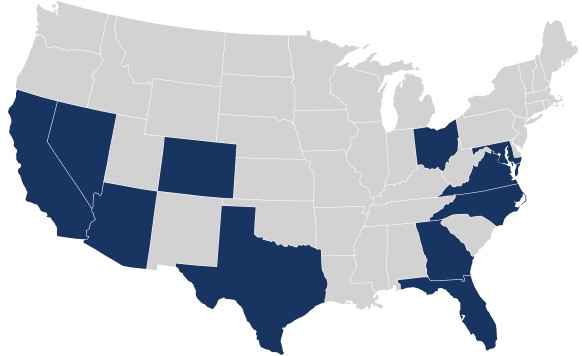

Targeted Markets

West

Bay Area

Denver

Las Vegas

Phoenix

Sacramento

Central

Austin

Columbus

Dallas

Houston

San Antonio

East

Atlanta

Baltimore

Charlotte

Northern Virginia

Jacksonville

Orlando

Raleigh

Southeast Florida

Suburban Maryland

Tampa

Other markets considered on a deal by deal basis.

Acquisition Criteria

Project Size Minimum 150 units. Portfolios are preferred.

Equity Contribution $1,000,000 to no practical limit.

Asset Quality Class B/C properties; other quality levels will be considered on a case by case basis.

Age Typically 1970’s and newer.

Design Style All, with Garden style being the most preferred.

Acquisition Criteria Properties requiring cosmetic or substantial rehab add value; under-performing

properties which may have market-related and/or management induced problems; and package transactions.

Acquisition “Complexity Unusual or difficult issues and problems will NOT preclude interest in a property.

Financing Financing will be in the form of new financing or assumption of existing debt, and in some cases all cash.

Cap Rates Determined on a case-by-case basis.

Broker Relationships Sourcing brokers will be protected and compensated for unlisted investments opportunities.